TABLE OF CONTENTS

Although many property managers cringe when they hear “Airbnb” or “short-term rentals” in relation to their property – a term that often evokes anxiety around residents breaking the rules – they may now be starting to wonder whether they should rethink their stance.

While single-family homeowners latched onto the appeal of listing their property as a short-term rental long ago, the trend is just beginning to pick up some steam in the multifamily industry.

Airbnb, the leader of the short-term rental market, even launched their own program in late 2022 to harness the interest here. Now with “Airbnb-friendly apartments,” properties can offer full time renters the opportunity to generate additional income by hosting their home on Airbnb. In the past few years, other options for flexible living have popped up, like Landing and Kasa, making it easier for property managers or owners to attract short-term renters and take advantage of empty units.

So, if you’ve been intrigued by the possibility, here are the pros, cons, and key considerations that you should be thinking through.

Short-term rentals at multifamily properties can take on a variety of forms. One approach is to simply allow your residents to “sublease” their apartments with a program like the Airbnb one mentioned above.

With this system, renters can host their own apartment for short-term use and then split the profits among themselves, the property, and Airbnb. This gives property managers more control over and insight into who is staying on their property, as well as an additional revenue stream.

The other option is for the property to lease empty units directly to short-term renters. Some properties choose to use this as an option for the interim when occupancy is low and they have many units sitting empty, some have dedicated furnished units that are always used for short-term rentals, and some properties take a hybrid approach.

Now that you’re clear on the different options that are available for incorporating short-term rentals at your multifamily property, let’s dig into some of the benefits and drawbacks.

Perhaps the broadest level benefit to allowing short-term rentals at your property is keeping pace with innovation. As of now, offering this as an option can be a competitive advantage over other properties in your area, but in certain markets it may soon become a necessary change to adapt to evolving needs of modern renters.

Ashley Greene, a property manager in Pennsylvania we spoke to emphasized this point:

“If you can’t get with the times and adapt to the lifestyles of renters, you’ll eventually fall off. This isn’t just a business. It’s a people business.”

In addition to this high-level benefit, there are several other key advantages that short-term rentals provide to multifamily properties.

By turning vacant units into short-term rentals during times of low occupancy, you can maximize the revenue potential for every unit.

Not only do short-term rentals fill the gaps between long-term leases, but they also offer even greater revenue potential. Forbes found that short-term rentals on average generate 30% more profit for property owners.

If you simply allow your residents to sublease their own units — and split the revenue with them — you can draw in more revenue even for the units that are filled.

As a whole, the short-term rental market generated over $62 billion in 2022 — a 25+% increase from the year before — and it’s projected to keep growing at a rate of 10% each year.

Multifamily property owners are primed to take advantage of this surge.

A Regional Vice President from one Landing partner property shared the impact that taking advantage of short-term rentals has made on their revenue.

"Since partnering with Landing, we have added more than $300,000 in monthly revenue, maintained exceptionally high occupancy, and improved the satisfaction of our residents as well as our employees,” Colby Robertson from American Landmark mentioned.

Short-term rentals also give multifamily properties a greater ability to adapt to evolving market conditions.

If long-term leasing slows down, properties can pivot by offering units on platforms like Kasa or Landing to capture new income streams. This can be used to offset downtime during tenant turnover periods helping to offset loss. (Not to mention, being able to have prospective tenants tour a nicely furnished apartment when it’s in short-term rental mode, rather than an empty unit).

On the flip side, during times of high occupancy, units can easily be converted back to traditional leases, giving property teams the ability to quickly pivot to support whatever is most profitable at that moment. Services like Landing even handle design and furnishing so that your on-site team can be more hands-off.

Offering up leases that are more flexible can also help you draw in new kinds of residents who wouldn’t be able to lease on a long-term basis. Groups of people like travel nurses, military families, digital nomads, or other groups that are prone to last-minute moves are much more likely to fill up your empty units if they have the option to lease on a short-term basis.

This benefit specifically applies if you allow your residents to lease out their own apartments on a short-term basis. Since many apartment complexes don’t allow this (for reasons that we’ll dig into deeper below), residents are likely to happily welcome the opportunity to make a little extra money, especially if their unit would have been sitting empty while they travel for a few months, for example.

While great customer service and high-quality amenities are exciting perks for residents, the opportunity to actually make money is a major differentiator for residents.

A couple from Denver, Ali and Eric, shared their positive experience living at an Airbnb-friendly apartment:

“Hosting has opened up so many doors for us. We get to live in an incredible apartment building, with out of this world amenities, and earn money on our place when we’re away.”

Overall, short-term rentals offer up a great opportunity for a more flexible, more profitable, more satisfactory property, but that’s not to say that it doesn’t come with its challenges.

Here are some of the key drawbacks of allowing short-term rentals at multifamily properties that will help you determine whether or not it’s the right fit for your property.

While short-term rentals offer benefits, they can also create challenges for long-term residents. Frequent guest turnover may lead to noise disruptions, a sense of insecurity, and dissatisfaction among tenants who feel their building is turning into a hotel rather than a community.

A NMHC/Grace Hill survey found that 27% of renters felt that short-term rentals would negatively affect their opinion of a community, and 19% said they would not rent in a building that allowed them. This indicates that short-term may alienate potential tenants, especially those seeking stability and community.

If you’re looking to implement short-term rentals, it’s important to consider how to mitigate any of these potential impacts by partnering with a trusted company offering a vetted program.

When you open up your property to short-term rentals, you may notice more wear and tear in common areas, like lobbies, elevators, and hallways. This increased usage can lead to higher maintenance costs and more frequent repairs.

This impact on operating expenses must be considered in comparison to the increased revenue potential to determine whether this change will lead to a net negative or net positive outcome.

Managing short-term rentals often requires additional resources, whether that means increasing your on-site staff or bringing some staff on-site for the first time.

Between the frequent cleanings, key handovers, guest communications, and unit inspections between stays, short-term rentals require a more hands-on approach than long-term rentals.

For example, one of our customers, Sentral, ended up becoming bogged down in tedious parking management tasks for their short-term guests before they implemented Parkade to automate much of the process.

Much like in Sentral’s situation, it’s often necessary to bring in third-party services to help you better manage short-term guest operations.

Multifamily properties may face stricter local regulations or zoning restrictions when it comes to short-term rentals. These restrictions can vary widely between cities, so it’s important to do your research to ensure that you’re aligning to all legal requirements.

There are also some additional taxes that you may be liable for if you’re renting out short-term units.

Heather Taylor from North Carolina shared with us,

“Check your local laws. Here in NC, anything under 90 days has to pay hotel taxes, and some insurance carriers won’t allow short-term rentals. I suggest aligning with a corporate housing partner to avoid legal headaches.”

Legal restrictions around short-term rentals vary widely between cities. Zoning laws and hotel tax requirements can impact a property’s ability to operate STRs legally.

For some properties, the cons may be too strong to justify the potential benefits. But for others, the drawbacks are far outweighed by the positive results. There’s no one clear answer to whether you should or shouldn’t; it’s simply a matter of doing a thoughtful cost-benefit analysis.

Perhaps the most important consideration in making this decision is determining whether the demand in your area for short-term rentals will make this a sustainable strategy.

High-traffic tourist areas or urban centers with business travelers, for example, are best positioned to reap the benefits. Suburban or rural areas with mostly long term residents are probably not the best places to implement this strategy.

Whether you allow residents to sublet out their apartments on a short-term basis or leverage empty units for short-term rentals, you will have to be intentional about getting ahead of any operational challenges.

By default, your property may not be suited for a hotel-like check-in experience, so it’s something you’ll have to get ahead of if you start allowing short-term rentals. You’ll have to consider how your guests will receive their keys, get any questions answered, or troubleshoot if they run into problems.

When it comes to some of the other day-to-day operations of short-term rentals, many properties find it helpful to pair up with a third-party short-term rental service, like Airbnb for example, to keep the process safe, streamlined, and compliant.

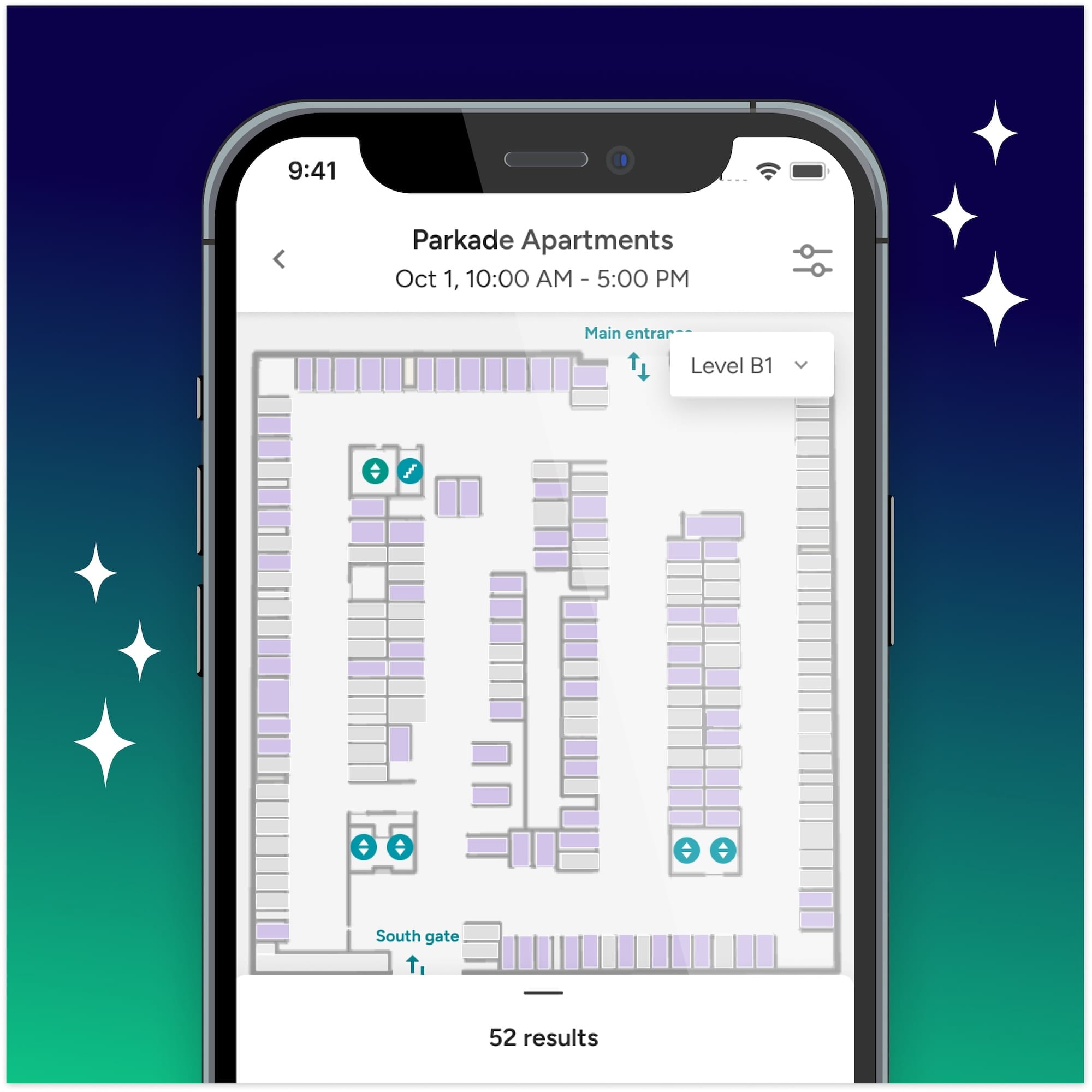

When it comes to short-term rentals, another area where teams often need extra support is parking. Especially if you currently have challenges with assigning spots and managing garage access, these problems will only be exacerbated by introducing short-term rentals into the mix.

One of our customers experienced this issue constantly before they implemented Parkade. Since guests needed to receive a fob in order to access the correct area of the parking garage, guests needed to park somewhere temporarily, grab the fob at check-in, and then head back to their car to move it. This led to cars getting towed or ticketed on the side of the road, or short-term guests parking in resident spots.

With a solution like Parkade, guests are able to access pre-approved parking areas through a tap on their phone. Being proactive about parking and check-in will help you ensure that you are keeping guest satisfaction high while minimizing staff time spent.

There are several pros and cons to allowing short-term rentals at your multifamily property. It could be a great opportunity to bring in some extra revenue for some properties, while it could simply be not feasible at others. We hope this piece helped you to weigh both sides to decide whether it will ultimately be the right decision for you.

.jpg)

As parking management becomes increasingly digital, security becomes critical — and we’re excited to share that we've achieved a major security milestone.

Read Story

We’re thrilled to announce one of our most significant leaps forward this year: the launch of dynamic maps across our mobile and web applications.

Read Story

Now that AB 1317 is official, it’s time to brush up on the requirements and see how your properties stand to benefit.

Read Story